Integrating Generative AI with Java Applications for Financial Advisory Services

In today’s rapidly changing financial horizon, personalized advisory services are no longer a luxury but a must-have. Clients demand tailored financial advice that accounts for their unique goals, risk tolerance, and market conditions. Enter generative AI models like GPT and Gemini, which are transforming how financial institutions deliver insights, automate processes, and enhance user experiences. When GPTs are integrated with robust Java-based applications, these AI models unlock powerful capabilities for building scalable, intelligent financial advisory tools. This article portrays the integration of generative AI with Java, focusing on practical implementation, REST API usage, and critical security and compliance considerations. By the end of this article, you’ll have a clear roadmap for developing AI-powered financial advisory services that are both effective and secure.

Without further due — let’s get started!

Understanding the Use of Generative AI in Financial Advisory

Generative AI refers to machine learning models capable of generating human-like content, such as text, code, or even structured data, based on the user’s input prompts. Models like OpenAI’s GPT (Generative Pre-trained Transformer) and Google’s Gemini excel at natural language processing (NLP), enabling them to understand and respond to complex user queries. In financial advisory services, these models can:

- Summarize financial data: Condense transaction histories or portfolio performance into concise, human-readable insights.

- Detect patterns and anomalies: Analyze historical data by identifying potential fraud or irregular spending patterns.

- Provide conversational advice: Answer user queries like “Should I invest in bonds this quarter?” with context-aware, personalized recommendations.

- Automate recommendations: Suggest investment strategies or budgeting tips based on user profiles and market trends.

Java, with its scalability, ecosystem, and enterprise-grade frameworks like Spring Boot, is an excellent choice for building the backbone of such AI-driven applications. By leveraging REST APIs, developers like us can effortlessly connect Java applications to generative AI models, enabling dynamic, real-time advisory services.

Why Java for AI Integration?

Java’s robustness, cross-platform compatibility, and extensive libraries make it a natural fit for integrating generative AI into financial applications. Key advantages include:

- Scalability: Java’s Spring Boot framework supports microservices architectures, enabling applications to handle large-scale financial data and user requests.

- Ecosystem: Libraries like Spring Data JPA, Hibernate, and LangChain4j simplify database interactions and AI integration.

- Security: Java’s built-in security features, such as Spring Security, ensure compliance with financial regulations like GDPR and PCI-DSS.

- Community and Support: Java’s mature ecosystem provides extensive documentation and community support, which is critical for enterprise-grade applications.

By combining Java’s strengths with generative AI, developers can create applications that are not only intelligent but also reliable and secure.

Integration Approach: REST APIs and LangChain

The most practical way to integrate generative AI with Java is through REST APIs. Providers like OpenAI and Google offer APIs that allow developers to send prompts to their models and receive responses in JSON format. Additionally, frameworks like LangChain simplify the orchestration of AI queries by handling prompt engineering, data preprocessing, and response formatting.

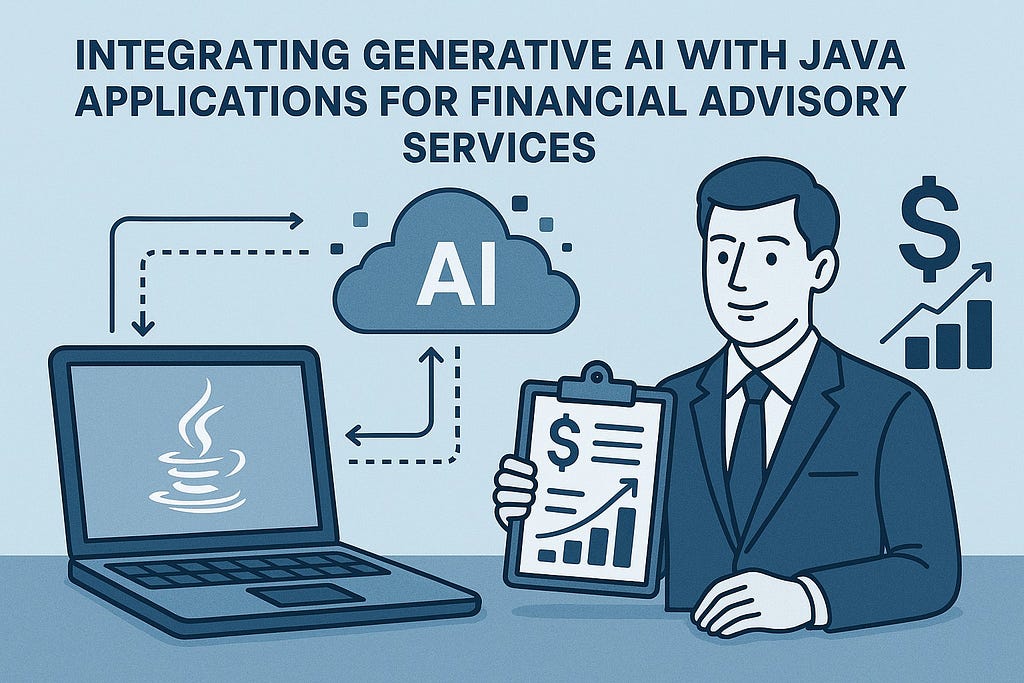

System Architecture

A typical architecture for a Java-based financial advisory application with generative AI includes:

- Frontend (Angular/React): A user-friendly interface for inputting queries, managing transactions, and viewing AI-generated insights.

- Backend (Spring Boot): It handles business logic, database operations, and API requests to the AI model.

- Generative AI (OpenAI/Gemini): Processes natural language queries and generates insights.

- Database (PostgreSQL): Stores transaction data, user profiles, and AI query logs.

Here’s a simplified pipeline:

[Frontend (Angular)] → [Backend (Spring Boot)] → [AI Model (OpenAI/Gemini)] → [Database (PostgreSQL)]

Step-by-Step Integration

Let’s break down the integration process using a financial advisory application as an example. The application allows users to manage transactions, query account summaries, and receive AI-driven financial advice.

Setting Up the Java Backend

We’ll use Spring Boot to create a RESTful backend that communicates with an AI model via APIs. Start by setting up a Spring Boot project with the following dependencies in your pom.xml:

pom.xml

<xaiartifact

artifact_id="8db03c47-40f1-480a-8833-241c74334ec8"

artifact_version_id="578723cf-38a3-4714-83ef-7342467a6995"

title="pom.xml"

contenttype="text/xml">

<?xml version="1.0" encoding="UTF-8"?>

<project

xmlns="http://maven.apache.org/POM/4.0.0"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"

xsi:schemaLocation="http://maven.apache.org/POM/4.0.0

http://maven.apache.org/xsd/maven-4.0.0.xsd">

<modelVersion>4.0.0</modelVersion>

<groupId>com.financial</groupId>

<artifactId>ai-advisory</artifactId>

<version>1.0-SNAPSHOT</version>

<properties>

<java.version>11</java.version>

<spring-boot.version>2.7.5</spring-boot.version>

</properties>

<dependencies>

<dependency>

<groupId>org.springframework.boot</groupId>

<artifactId>spring-boot-starter-web</artifactId>

</dependency>

<dependency>

<groupId>org.springframework.boot</groupId>

<artifactId>spring-boot-starter-data-jpa</artifactId>

</dependency>

</dependencies>

</project>

</xaiartifact>

This setup includes Spring Boot for REST APIs, Spring Data JPA for database interactions, PostgreSQL as the database, and LangChain4j for AI integration.

Configuring the Database

Set up a PostgreSQL database with a transactions table to store financial data. Configure the database connection in application.properties:

spring.datasource.url=jdbc:postgresql://localhost:5432/financialdb

spring.datasource.username=your_username

spring.datasource.password=your_password

spring.datasource.driver-class-name=org.postgresql.Driver

spring.jpa.hibernate.ddl-auto=update

Define the Transaction entity:

Transaction.java

package com.financial.aiadvisory.entities;

import javax.persistence.*;

import java.time.LocalDateTime;

@Entity

@Table(name = "transactions")

public class Transaction {

@Id

@GeneratedValue(strategy = GenerationType.IDENTITY)

private Long id;

private Long accountId;

private String type; // DEBIT or CREDIT

private String status; // PENDING, EXECUTED, CANCELED

private Double amount;

private LocalDateTime date;

// Getters and Setters

public Long getId() { return id; }

public void setId(Long id) { this.id = id; }

public Long getAccountId() { return accountId; }

public void setAccountId(Long accountId) { this.accountId = accountId; }

public String getType() { return type; }

public void setType(String type) { this.type = type; }

public String getStatus() { return status; }

public void setStatus(String status) { this.status = status; }

public Double getAmount() { return amount; }

public void setAmount(Double amount) { this.amount = amount; }

public LocalDateTime getDate() { return date; }

public void setDate(LocalDateTime date) { this.date = date; }

}

Integrating Generative AI with LangChain

Configure LangChain to connect to OpenAI’s API:

OpenAiConfig.java

package com.financial.aiadvisory.config;

import dev.langchain4j.model.openai.OpenAiChatModel;

import dev.langchain4j.service.spring.AiService;

import org.springframework.context.annotation.Bean;

import org.springframework.context.annotation.Configuration;

@Configuration

public class OpenAiConfig {

@Bean

public OpenAiChatModel openAiChatModel() {

return OpenAiChatModel.builder()

.apiKey("your-openai-api-key")

.modelName("gpt-4o-mini")

.build();

}

}

Now, create an AI agent interface for handling user queries:

FinancialAgent.java

package com.financial.aiadvisory.agent;

import dev.langchain4j.service.SystemMessage;

import dev.langchain4j.service.spring.AiService;

@AiService

public interface FinancialAgent {

@SystemMessage("You are a financial advisor assistant. Provide accurate and concise financial advice based on user queries and transaction data.")

String advise(String userQuery, String transactionData);

}

Building the Backend Service Layer

Implement a service to fetch transaction data and interact with the AI model:

TransactionService.java

package com.financial.aiadvisory.service;

import com.financial.aiadvisory.agent.FinancialAgent;

import com.financial.aiadvisory.entities.Transaction;

import com.financial.aiadvisory.repository.TransactionRepository;

import org.springframework.beans.factory.annotation.Autowired;

import org.springframework.stereotype.Service;

import java.util.List;

import com.fasterxml.jackson.databind.ObjectMapper;

@Service

public class TransactionService {

@Autowired

private TransactionRepository transactionRepository;

@Autowired

private FinancialAgent financialAgent;

@Autowired

private ObjectMapper objectMapper;

public List<Transaction> getAllTransactions() {

return transactionRepository.findAll();

}

public Transaction saveTransaction(Transaction transaction) {

return transactionRepository.save(transaction);

}

public String getFinancialAdvice(String userQuery, Long accountId) throws Exception {

List<Transaction> transactions = transactionRepository.findByAccountId(accountId);

String transactionData = objectMapper.writeValueAsString(transactions);

return financialAgent.advise(userQuery, transactionData);

}

}

Exposing REST APIs

Now, we need to create a controller to handle the API requests:

TransactionController.java

package com.financial.aiadvisory.web;

import com.financial.aiadvisory.entities.Transaction;

import com.financial.aiadvisory.service.TransactionService;

import org.springframework.beans.factory.annotation.Autowired;

import org.springframework.http.ResponseEntity;

import org.springframework.web.bind.annotation.*;

import java.util.List;

@CrossOrigin("*")

@RestController

@RequestMapping("/api")

public class TransactionController {

@Autowired

private TransactionService transactionService;

@GetMapping("/transactions")

public ResponseEntity<List<Transaction>> getAllTransactions() {

return ResponseEntity.ok(transactionService.getAllTransactions());

}

@PostMapping("/transactions")

public ResponseEntity<Transaction> createTransaction(@RequestBody Transaction transaction) {

return ResponseEntity.ok(transactionService.saveTransaction(transaction));

}

@GetMapping("/advice")

public ResponseEntity<String> getAdvice(@RequestParam String query, @RequestParam Long accountId) throws Exception {

return ResponseEntity.ok(transactionService.getFinancialAdvice(query, accountId));

}

}

Frontend Integration with Angular

When everything else is done, we must build an Angular frontend to interact with the backend. Let’s create a component for transaction management and AI queries:

transaction.component.html

<div class="container p-3">

<h3 class="text-center">Financial Advisory Dashboard</h3>

<div class="card mb-3">

<div class="card-body">

<h5>Ask Financial Advice</h5>

<div class="input-group">

<input [(ngModel)]="question" type="text" class="form-control" placeholder="Enter your query (e.g., 'Summarize my transactions')">

<button class="btn btn-primary" (click)="askAgent()">Ask</button>

</div>

<div class="mt-3" *ngIf="response">

<h6>AI Response:</h6>

<p>{{ response }}</p>

</div>

</div>

</div>

<div class="card">

<div class="card-body">

<h5>Transaction History</h5>

<table class="table table-striped">

<thead>

<tr>

<th>ID</th>

<th>Date</th>

<th>Account ID</th>

<th>Type</th>

<th>Amount</th>

<th>Status</th>

</tr>

</thead>

<tbody>

<tr *ngFor="let transaction of transactions">

<td>{{ transaction.id }}</td>

<td>{{ transaction.date }}</td>

<td>{{ transaction.accountId }}</td>

<td>{{ transaction.type }}</td>

<td>{{ transaction.amount }}</td>

<td>{{ transaction.status }}</td>

</tr>

</tbody>

</table>

</div>

</div>

</div>

The html structure should provide you with an output like the one below:

Now, the fun part. Yes, you got me right! We’ll add the typescript.

transaction.component.ts.

@Component({

selector: 'app-transaction',

templateUrl: './transaction.component.html'

})

export class TransactionComponent implements OnInit {

transactions: any[] = [];

question: string = '';

response: string = '';

private apiUrl = 'http://localhost:8080/api';

constructor(private http: HttpClient) {}

ngOnInit() {

this.getAllTransactions();

}

getAllTransactions() {

this.http.get(`${this.apiUrl}/transactions`).subscribe({

next: (data: any) => this.transactions = data,

error: err => console.error(err)

});

}

askAgent() {

this.http.get(`${this.apiUrl}/advice`, {

params: { query: this.question, accountId: '11' }

}).subscribe({

next: (data: any) => this.response = data,

error: err => console.error(err)

});

}

}

Example Workflow

When a user inputs a query like “Summarize my transactions for the last quarter,” the flow is as follows:

- Frontend: The Angular component sends the query to the backend via the /api/advice endpoint.

- Backend: The TransactionService fetches relevant transactions from PostgreSQL, formats them as JSON, and passes them to the FinancialAgent.

- AI Model: LangChain structures the prompt (for example: “Summarize the following transactions: [JSON data]”) and sends it to OpenAI’s API.

- Response: The AI model returns a summary, which is formatted and sent back to the frontend for display.

Example output:

For account ID 11, total credits in the last quarter are $105,028.47, and total debits are $163,709.31. Key trends include high debit activity in early February, suggesting increased spending.

Security and Compliance Considerations

Financial applications are subject to strict regulations like GDPR, PCI-DSS, and SOC 2. So, when you are integrating generative AI, consider the following:

1. Data Privacy

- Encryption: Use HTTPS for API calls and encrypt sensitive data (e.g., account IDs, amounts) in transit and at rest.

- Data Anonymization: Before sending transaction data to the AI model, anonymize personally identifiable information (PII) to comply with GDPR.

- Secure API Keys: Store API keys in environment variables or a secure vault, not in source code.

2. Model Security

- Prompt Injection: Sanitize user inputs to prevent prompt injection attacks, where malicious inputs manipulate the AI model’s behavior.

- Rate Limiting: Implement rate limiting on API endpoints to prevent abuse and manage costs.

3. Compliance

- Audit Logs: Log all AI queries and responses in a separate table (e.g., llm_logs) for auditing and compliance with regulations like SOC 2.

- Data Retention: Ensure transaction data and AI responses are retained only as long as necessary per regulatory requirements.

4. Ethical AI Use

- Bias Mitigation: Regularly evaluate AI outputs for biases in financial recommendations, especially when advising diverse user groups.

- Transparency: Inform users when they are interacting with AI-generated advice and provide options to escalate to human advisors.

Practical Example: Anomaly Detection

To illustrate, let’s extend the application to detect fraudulent transactions. The user inputs: “Are there any anomalies in my transactions?” The backend fetches transaction data, and LangChain formats a prompt:

“Analyze the following transactions for account ID 11 and detect any irregular patterns: [JSON data].”

The AI model might respond:

“Transactions with IDs 1 and 3 have unusually high debit amounts ($63,451.11 and $36,504.83) compared to the account’s average debit of $10,000. These warrant further investigation.”

The response is displayed on the frontend, and the backend logs the query for auditing.

Scaling and Future Enhancements

If you want to scale the application for enterprise use, consider some essential things mentioned below:

- Microservices: Break down the backend into microservices for transaction management, AI processing, and user authentication.

- Real-Time Alerts: Use WebSockets to push AI-generated real-time alerts (fraud detection) to users.

- Multi-Model Support: Integrate multiple AI models (e.g., GPT and Gemini) to compare performance and reduce dependency on a single provider.

- Advanced Analytics: Incorporate machine learning models for predictive analytics, such as forecasting user spending patterns.

Wrapping Up

Integrating generative AI with Java applications opens up exciting possibilities for financial advisory services. By leveraging Spring Boot, LangChain, and REST APIs, developers can create scalable, intelligent systems that deliver personalized insights, detect fraud, and simplify complex financial queries. With careful attention to security and compliance, these applications can meet the rigorous demands of the financial industry. Whether you’re building a budgeting tool or a full-fledged investment platform, the combination of Java and generative AI provides a robust foundation for delivering value to users.

For further exploration, consider experimenting with the code provided and exploring additional AI features like predictive analytics or multi-lingual support. The future of financial advisory is AI-driven, and Java is the perfect partner to bring it to life.

Author’s Note: This article is intended for developers and architects exploring AI integration in fintech. It does not constitute financial advice.

Integrating Generative AI with Java Applications for Financial Advisory Services was originally published in Javarevisited on Medium, where people are continuing the conversation by highlighting and responding to this story.

This post first appeared on Read More